1548 The Greens Way – Ste. 4 Jacksonville Beach FL 32250

Yearly Archives: 2023

Multi-State Tax Issues and Residency

Multi-state tax issues impact many taxpayers, including businesses, employees, and individuals. If you are someone who lives portions of the year in multiple states or moves around throughout the year, multi-state tax issues are especially relevant to you. Different states have different income taxes, property…

What Is Florida Sales Tax & How Does It Work?

A sales tax is applied to the final cost of certain goods and services and pays the state or local governmental body. As Florida doesn’t have a personal income tax, state and local income largely comes from sales taxes and property taxes. Sales taxes are…

IRS Bank Account Levy Definition & Examples

When you fail to pay the Internal Revenue Service (IRS), the agency has the authority to place a levy on a bank account, tax return, or other property. A levy is the legal seizure of these assets, and you have a short window of time…

Frequently Asked Questions About Florida Tax Lawyers

Tax law is often complicated and difficult for individuals to navigate. For many taxpayers, it is much easier to work with a Florida tax lawyer who has the resources and experience necessary to deal with tax law. Whether you are dealing with tax problems or…

How to Get Out of Tax Debt in Florida

It is surprisingly easy to get behind on tax payments, whether you are an individual or part of a company. If you miss one or two payments due to an unexpected drop in income and then accrue interest on those missed payments, then before too…

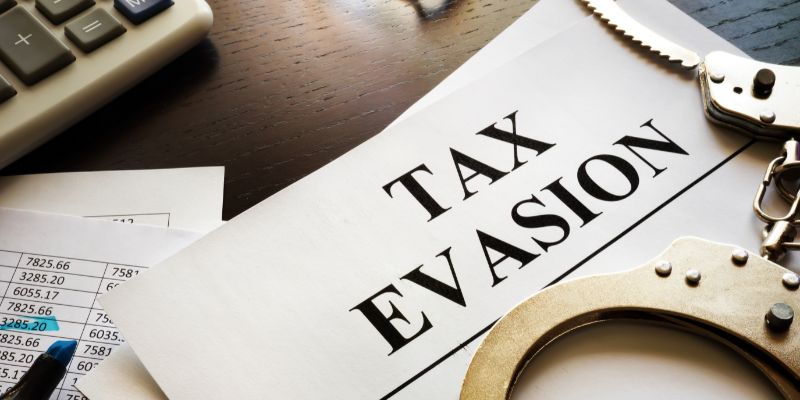

What Is Tax Evasion in Florida?

Paying a large sum for taxes can be frustrating, whether it is because you no longer have dependents to claim or you are bringing in more income because the higher payment could create financial strain. It is easy to be tempted to find new ways…

How to Respond to IRS Notice of Deficiency & IRS Form 5564 Waiver

When filing taxes each year, most people work very hard to ensure that they provide information and documentation that is accurate to their current circumstances because they do not want to face the consequences of an incorrect tax return. If your parents passed away during…

Payroll Tax vs. Income Tax – What Is the Difference?

Unless you are a trained professional, it can be difficult to fully understand the ins and outs of both federal and state taxes. You are responsible for paying a certain amount each year, but it is not always clear how much you have to pay…

Can You Buy a House If You Owe Federal Taxes in Florida?

If you are planning on purchasing a house, and you owe federal taxes, you may have options that allow you to meet your goal of home ownership, even though you owe the IRS, depending on your situation. The most ideal way to buy a home…

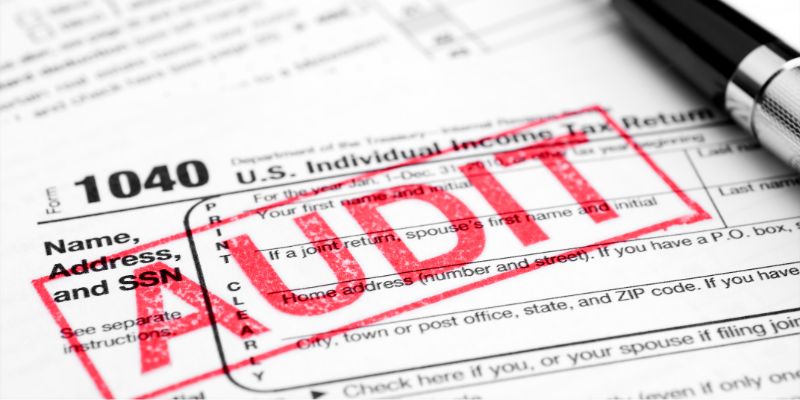

IRS Tax Audit Process: What to Expect?

There has been a great deal of discussion about the $80 billion operating budget the Internal Revenue Service (IRS) received as part of a plan to reverse inflation. This legislation, coined the Inflation Reduction Act, includes plans to make the IRS a world-class customer service…

Locations We Serve

- Alabama

- Arizona

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida – HQ

- Georgia

- Idaho

- Illinois

- Indiana

REQUEST A CONSULTATION

Please fill out the Contact Request Form and a Tax Attorney/Paralegal will call you

to discuss legal representation or to schedule your free initial consultation